receiving letter from law firm about debt collection

If youve received a call or letter from an attorney regarding a debt that you owe youre probably wondering how to respond. Dear client name This is another reminder our law firm has yet to receive the XXXX on invoice No.

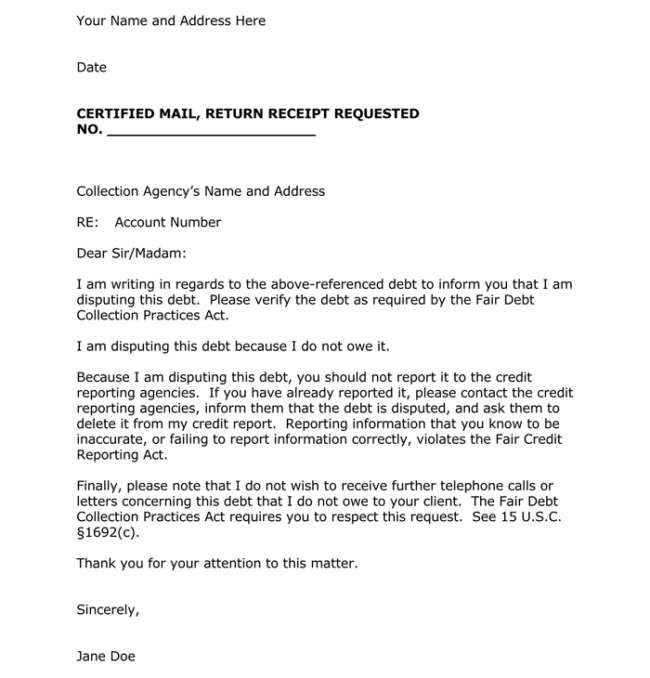

What Does The Debt Collector Have To Tell You About Your Debt In 2021 Debt Collector Debt Collection Debt Settlement

A new due date or immediately upon receipt of the letter.

. But a letter from a lawyer for debt collection does not mean you will be taken to court the next morning. If you have checked off all the items on the list and still have questions about a debt collection notice youve received Consumer. In light of that weve laid out the steps you should take.

When someone receives a letter from a lawyer it can be frightening so there are rules the lawyer must follow in order to act as a debt collector. The letter also demands payment. 1234 for Downtown Law Firm.

It also highlights the consequences of missing the payment deadline. Though it doesnt necessarily mean you are being sued the fact that the creditor andor a collection agency have engaged a law firm could indicate that they are close to filing suit. If you have already sent us your payment kindly disregard this letter.

If you write back requesting proof of the obligation you are only buying time. The goal is that the person. A debt collection letter on a provider law firms letterhead can make a significant impact.

To do this they send debt collection letters. They would rather reach out to you and see if a payment plan can be reached. Put simply these remind an individual that they owe money.

Dont do the following. You may not know what to do next if you are not in a position to clear the outstanding amount immediately. You should read the letter carefully and respond in a timely manner.

Borland and Associates about paying the debt. In this case it is a lawsuit filed by a collection lawyer. The primary purpose of the debt collection letter is to inform a debtor their payment is due formally.

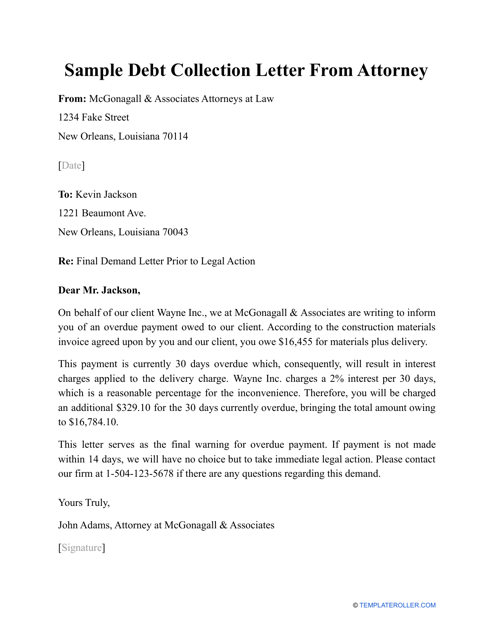

A demand letter from an attorney for collection of debt is a formal notice sent to a debtor by a lawyer on behalf of their client to request the payment of an outstanding bill. Most debt collectors use mail as their primary collection tool. Get mad and so ignore.

If a borrower doesnt pay their bill then the collector buys these past-due payments from the business or creditor. Frequently these notices are sent in order to try and frighten or intimidate you into paying even though you have the legal right to dispute the debt within 30 days of receiving the letter. This letter is usually a form letter that is sent out before litigation has begun.

All small business plans include a certain number of demand for payment letters each month and year written and sent by. The Debt Collection Letter must comply with Fair Debt Collection Practices in your state and Federally. The mail is from a San Diego law firm and right there in the envelopes address window it says ominously You may.

Generally you are given 30 days to respond and dispute the debt or point out inaccuracies. It highlights when the payment was due and urges the debtor to clear. 23 2018 3 AM PT.

All too often these letters infer that if you dont pay you will be taken to court. The debt collector may also offer to accept a settlement from him for a reduced amount. Also save all debt collection letters either in hard copy or electronically.

The next step you should take before paying a debt collector is to send a debt verification letter asking the collector to outline the debt what you owe and other information pertaining to the debt. The letter will usually state that the creditor has retained the law firm in order to represent it in collecting the debt. Once your debt is assigned to a collection law firm you will typically receive a letter requesting payment of your debt.

While a debt collection letter from a law firm isnt reason to panic it is something that you should take seriously. The initial date the full amount or payment was due. This rule exists because collection agencies know that a letter from an attorney is more likely to frighten the.

If the offer is originally made verbally over the phone have your son ask to receive it in writing from the collection agency. The Purpose of a Debt Collection Letter. He should wait to make a decision whether or not to accept the offer until he receives their offer letter outlining the terms.

We value your business and hope to keep you as a. Please be aware that if payment does not arrive by date of 60 days past due legal action may be taken to enforce your obligation to pay. Inform debtors of an outstanding debt.

Im just now getting able to pay the debt and I received a letter from Brett M. Would I pay this law firm or the original debt collector National Credit Systems. Receiving this formal notice reminds you of the outstanding debt and sets a payment deadline.

A debt collection letter is sent to. So you got a letter from a collection agency because it thinks you owe a debt and its try to collect the debt from you. LegalShield small business members often receive better results by having their lawyer assisting in the debt collection process.

Take advantage of the warning almost like a radar that tells you something bad is about to hit. The letter should include the following information. The amount of the debt.

A former apartment complex charged me 610 after moving out for breaking the lease and immediately sent it to collections. There is some good that comes from these letters it is like an early warning system that a collection lawsuit is coming. Typically creditors send the debt collection agency if you fail to pay creating potential grounds for collector harassment.

Fortunately no matter which method of communication the law firm has used to get in contact with you the process for responding is pretty much the same on your end. If not please send us your payment promptly. For example the letter must be very clear that the lawyer is only helping to collect the.

It costs money to file a lawsuit and collection firms do not want to pay it right away. Debt collectors do exactly what it sounds like they docollect debts. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Validation letters are legally required under the FDCPA. This is our second reminder that payment on your account in the amount of ________ on your account was due on ________. However if you have defaulted on your payments receiving a letter from a law firm about debt collection can be traumatizing.

It provides details of the debt in default including the date it was accrued and the total amount. Both Federal and State law require that any time the law firm sends a collection letter to the consumer regarding the debt they must be clear that they are acting only as a debt collector. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

You have not been sued yet. Reference invoice numbers contract agreements etc. Read each debt collection letter you receive carefully.

A debt collection letter is a formal notice that businessesincluding law firms give to a client who hasnt paid their bill by the agreed-upon date. This type of letter informs the recipient of their outstanding debt requests that they pay by a certain date and lets them know what will happen should they fail to pay. They then try to collect what the person owes.

Debt collection letters can be issued to both commercial and consumer debtors. Normally the letter will also state that the debtor has 30 days to dispute the debt and gives instructions on how such a. This letter is a red flag particularly if the law firms address is in your state.

There are also a few special rules for law firms acting as collection agencies. Typically these letters are sent within five days of the first collection call you receive. Yours truly FOLLOW UP COLLECTION LETTER.

As far as I know the debt never went to a collection agency but straight to a collection law firm saying that they are suing due to failure to respond to original collection request and failure to pay immediately which I cant do until I start working I graduate this year and will start working in the summer while also having a baby.

Free Payoff Demand Letter Template Doc Policy Template Lettering Letter Templates

Letter Template Pay To Delete Letter 3 Brilliant Ways To Advertise Letter Template Pay To De Credit Repair Letters Letter Templates Credit Repair Business

How To Respond To A Debt Collection Letter And What To Include In A Debt Validation Letter Toughnickel Money Debt Collection Debt Collection Letters Debt

Collection Dispute Letter How To Write A Collection Dispute Letter Download This Collection Di Credit Repair Letters Letter Templates Credit Repair Business

Free Debt Collections Letter Template Sample Pdf Word Eforms

10 Day Demand Letter For Payment Eforms Free Fillable Forms Lettering Letter Templates Fillable Forms

Debt Collection Letter Samples For Debtors Guide Tips

Sample Debt Collection Letter From Attorney Download Printable Pdf Templateroller

Free Debt Collector Creditor Cease And Desist Letter Pdf Word Eforms

Sample Debt Collection Letter From Attorney Download Printable Pdf Templateroller

Explore Our Example Of Charge Off Dispute Letter Template Credit Repair Letters Credit Repair Business Lettering

Demand Letter Templates Free Sample Example Format Download For Payment Invoice Amount Word Cover Letter Template Free Lettering Simple Cover Letter Template

Demand For Payment Letter Check More At Https Nationalgriefawarenessday Com 5696 Demand For Payment Lett Letter Templates Free Lettering Word Template Design

Debt Collection Letter Jma Credit Control Debt Collection Letters Collection Letter Debt Collection

Explore Our Example Of Charge Off Dispute Letter Template Credit Repair Letters Credit Repair Business Lettering

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Get Our Sample Of Charge Off Dispute Letter Template For Free Collection Letter Letter Templates Debt Collection Letters

Debt Dispute Letter Template Letter Templates Business Letter Template Lettering

Pin By Jerrica Jerrica On Credit Repair Letters In 2022 Credit Repair Letters Financial Life Hacks Money Management Advice